The power tools market is undergoing an unprecedented transformation. Rapid technological advancements, shifting consumer demands, and the acceleration of industry automation are reshaping the market landscape.

By 2025, the global power tools market is expected to surpass $40 billion, marking the beginning of a new phase of growth. This article will explore the key trends shaping the power tools market in 2025.

Market Analysis: Drivers of Growth in the Global Power Tool Market

As the global economy rapidly develops, the demand for power tools is steadily rising across various regions. The innovation of power tool technologies, the ongoing automation in industries, and the acceleration of infrastructure development are the key factors driving the growth of the global power tool market. Below is an in-depth analysis of the power tool markets in North America, Europe, Asia-Pacific, and Africa.

North American Market

North America, particularly the United States and Canada, has always been a significant pillar of the global power tool market. According to Statista, the U.S. power tool market is expected to surpass $10 billion in annual sales by 2025. The demand from industries such as construction and automotive repair is driving the sales of high-performance power tools.

Infrastructure development has long been a key driver of economic growth, with large commercial and residential projects on the rise, leading to a steady increase in the demand for power tools. Whether it’s for drilling, cutting, or installation, power tools greatly enhance construction efficiency.

The importance of power tools in automotive repair and assembly is becoming more prominent, especially with the rise of electric vehicles (EVs). This shift is driving the demand for tools with higher torque capabilities and smart, connected devices.

The DIY culture is also growing in the U.S. and Canada, especially among younger consumers. People are increasingly choosing convenient, efficient power tools to handle home repairs and remodeling projects.

European Market

Europe has long been a leader in power tool research and development, and this advantage continues to hold as market demand evolves. According to Grand View Research, the European power tool market is expected to grow at an average annual rate of around 5% over the next five years.

Green building and sustainable development have long been key principles in Europe, with increasing consumer demand for environmentally-friendly power tools. Low-emission, high-performance tools have become a major trend in the market.

The manufacturing industry in Europe, especially in countries like Germany, France, and the UK, heavily relies on high-precision power tools for precise machining and assembly. With the continuous growth of the manufacturing sector, the demand for power tools is further increasing.

Asia-Pacific Market

Asia-Pacific, particularly China and India, is becoming a major engine for growth in the global power tool market. According to Zion Market Research, the power tool market in this region is expected to grow at a rate of over 8% annually by 2025, making it the fastest-growing region in the world.

China’s rapid urbanization and infrastructure development have significantly driven the growth of the power tool market, particularly in construction and manufacturing sectors, where there is a sharp rise in the demand for efficient and reliable tools.

India’s manufacturing and construction industries are also developing rapidly, leading to an increase in the demand for power tools. As industrialization progresses, power tools are becoming more common in metalworking, assembly, and other applications.

The accelerated automation in Asia-Pacific’s manufacturing sector is driving the demand for smart power tools and high-precision tools. Features such as IoT technology and remote monitoring are becoming key industry trends.

African Market

Although Africa’s power tool market is smaller in size, it holds tremendous growth potential. According to a report by Frost & Sullivan, Africa’s power tool market is expected to grow at an annual rate of 7% by 2025, driven by infrastructure development and industrialization.

As African countries increase investments in transportation, energy, and housing sectors, the use of power tools in construction and roadwork is expanding. Tools like electric drills, impact wrenches, and saws are being widely used in large-scale construction projects.

Certain African countries, particularly Nigeria, South Africa, and Kenya, are pushing forward the growth of the manufacturing sector, leading to an increased demand for power tools. As industrialization accelerates, the need for power tools in metalworking, assembly, and other areas is also rising.

Many globally recognized power tool brands, such as Bosch and Kafuwell, are entering the African market and expanding through partnerships with local distributors. At the same time, some local brands are emerging, offering affordable power tools tailored to local needs.

What Are the High Demand Industry Tools?

The rapid growth of the power tools market is driven not only by technological advancements but also by the evolving needs of various industries.

Construction Industry

In the construction industry, efficiency and durability are the primary drivers behind the demand for power tools. As project sizes and complexity increase, traditional hand tools are no longer sufficient to meet the demands for speed and high-quality construction. As a result, the use of power tools in the construction industry has grown significantly. Below are some of the most in-demand tools in the construction sector:

- Cordless Drills and Impact Drills: These tools have become essential on modern construction sites. Cordless drills not only perform drilling and screw-driving functions, but they also overcome the limitations of traditional corded tools in construction environments. Their high torque output is particularly important in construction work.

- Cordless Saws: Power saws (including circular saws, chain saws, etc.) are commonly used for cutting on construction sites. In the past, electric saws required a power cord, but now the widespread use of cordless saws allows workers to operate them anywhere, cutting materials such as wood, metal, and concrete.

- Electric Nail Guns and Staplers: Electric nail guns have become standard tools in the construction industry, especially for tasks like framing, roofing, and finishing work. Compared to traditional hammers, electric nail guns significantly increase work efficiency and reduce the physical strain on workers.

Manufacturing Industry

With the rise of industrial automation, there is an increasing demand for tools with greater precision, reliability, and durability in the manufacturing process. Below are some of the power tools seeing increased demand in the manufacturing sector:

- Cordless Sanders and Grinding Tools: In manufacturing, especially in metal and plastic processing, there is a significant need for surface finishing. Sanders and grinding tools offer precise surface treatment and need to operate in confined or hard-to-reach spaces. Cordless tools are particularly advantageous in these situations, making them ideal for tasks in tight spaces or areas that are difficult to access with corded tools.

- Precision Drilling and Tapping Tools: In industries like aerospace, automotive manufacturing, and high-precision electronics, the accuracy of drilling and tapping tools is crucial. Modern precision drilling and tapping tools now integrate sensor technology that provides real-time feedback on key metrics such as drilling depth and tapping conditions. These smart tools can work seamlessly with other equipment and production lines, improving efficiency, reducing human errors, and minimizing downtime.

- Laser Measurement Tools: Quality inspection is critical for precision assembly. Traditional measurement methods often suffer from long processing times, errors, and operational inefficiencies. Laser measurement tools, on the other hand, provide instant, accurate results in three-dimensional space, reducing human error and enhancing automation levels in production.

Automotive Industry

With the rise of electric vehicles (EVs), the automotive industry has seen a significant shift in its demand for power tools, with an increased focus on tool adaptability, durability, and high-torque performance. Below are some of the key tools in high demand in the automotive sector:

- Cordless Impact Wrenches: Cordless impact wrenches are widely used in automotive repair and assembly, particularly for fastening and loosening bolts in engines and chassis. These tools ensure precise bolt tightening, preventing over-tightening or under-tightening, and reducing the risk of failures caused by improper handling during repairs.

- Electric Screwdrivers and Fastening Tools: Electric screwdrivers and other fastening tools are crucial on automotive assembly lines. These tools provide precise torque control, reduce human error, and enhance production efficiency. By 2025, smart fastening tools will make production processes even more flexible and efficient, with some tools automatically adjusting their output based on the size and material of the screw.

Power Tools Brands

The power tools market is growing rapidly, with major brands responding to intense competition through innovation, technological advancements, and product diversification. Below, we introduce some of the leading power tool brands worldwide.

Bosch

Bosch is one of the world’s leading power tool manufacturers, known for its high-quality, high-performance products. The brand has long been at the forefront of innovation, particularly in cordless tools, smart tools, and automation. Bosch’s advancements in battery technology and smart diagnostic tools have helped the company secure a strong presence in both the European and North American markets. With a broad market network and excellent after-sales service, Bosch is expected to continue being a key player in 2025.

Milwaukee

Another major player in the power tool industry is Milwaukee, which has earned a solid reputation in the construction and maintenance sectors. Their M18 cordless tools are highly regarded for their outstanding battery performance and impressive power output, making them a favorite among professionals. Milwaukee’s strategy focuses on continually releasing new cordless tools, as well as innovative features like high-performance batteries and more powerful torque tools, helping them stay ahead of the competition.

DeWalt

DeWalt is a household name in the power tool industry, with a strong influence in construction, manufacturing, and automotive repair. The brand is known for its constant innovation and advanced battery technology, improving the performance and durability of its tools. For example, the FlexVolt series represents a significant leap in power tool technology, offering higher power output and longer battery life.

Hitachi Koki

Hitachi Koki, while perhaps less well-known in Western markets, has a strong presence in the Asia-Pacific region and other parts of the world. The brand has been expanding its power tool business through innovation and acquisitions. Hitachi’s products are known for being lightweight, durable, and cost-effective, and the company is heavily investing in developing tools that meet the growing demand for smart technology.

Stanley

Stanley is a long-established brand in the tool industry and holds a significant position in the power tool market as well. The company has always focused on research and development, particularly in the DIY and light industrial sectors. Stanley’s products offer a combination of practicality and affordability, and the brand is exploring new areas such as smart technology, battery improvements, and eco-friendly solutions.

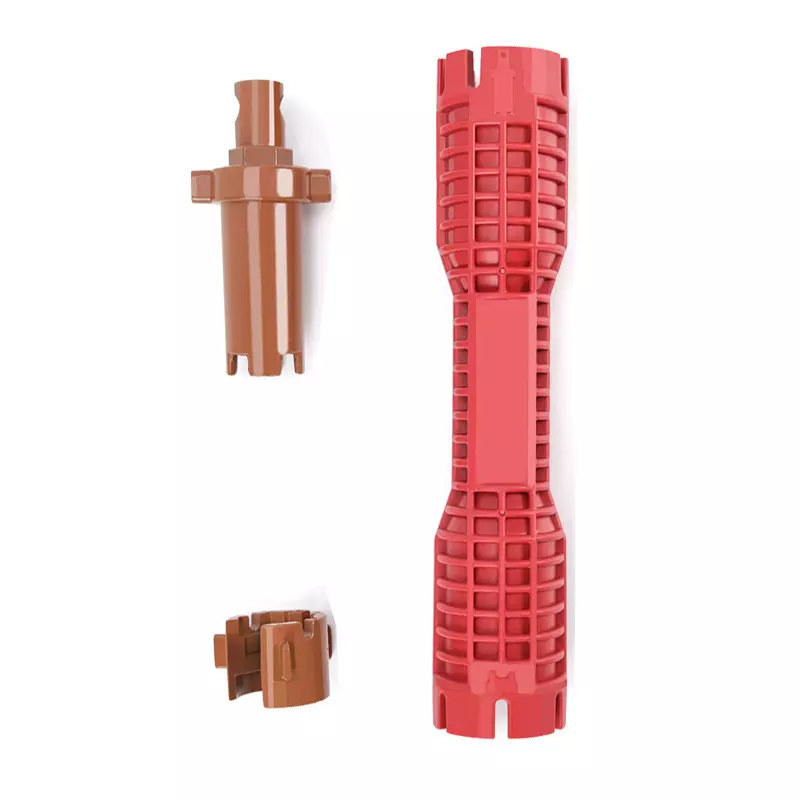

Kafuwell

In addition to these well-established companies, a growing number of brands are making their mark, including Kafuwell from China. This brand focuses on offering a wide range of products, from household tools to industrial-grade solutions, with each item carefully designed to meet the specific needs of different customer groups. Kafuwell tools perform excellently in both everyday use and demanding professional applications.

This also presents an opportunity for distributors. By introducing emerging brands like Kafuwell, they can expand their product offerings and attract more consumers who value a balance of price and quality. Kafuwell’s products are priced 20-30% lower than well-known brands, allowing distributors to gain more profit margin while meeting the growing demand for cost-effective tools in the market.

Summary

The power tools industry will see significant opportunities in the coming years, with cordless power tools taking the lead. As industries like construction, manufacturing, and automotive continue to grow globally, the demand for high-performance power tools will keep expanding. Over the next five years, staying ahead of industry trends and accelerating technological innovation will be key to success for businesses.